All Categories

Featured

In 2020, an estimated 13.6 million U.S. households are approved investors. These homes regulate huge riches, approximated at over $73 trillion, which stands for over 76% of all exclusive riches in the united state. These investors join financial investment possibilities normally unavailable to non-accredited financiers, such as financial investments in private companies and offerings by specific hedge funds, personal equity funds, and financial backing funds, which enable them to grow their wealth.

Check out on for information regarding the current accredited capitalist alterations. Funding is the gas that runs the financial engine of any type of country. Banks generally money the majority, but seldom all, of the capital called for of any type of purchase. There are situations like start-ups, where financial institutions don't supply any funding at all, as they are unproven and considered risky, yet the requirement for funding remains.

There are largely 2 rules that permit providers of protections to offer unrestricted quantities of protections to financiers. reg d accredited investor definition. Among them is Guideline 506(b) of Policy D, which enables an issuer to market securities to limitless recognized investors and approximately 35 Advanced Capitalists only if the offering is NOT made via basic solicitation and general marketing

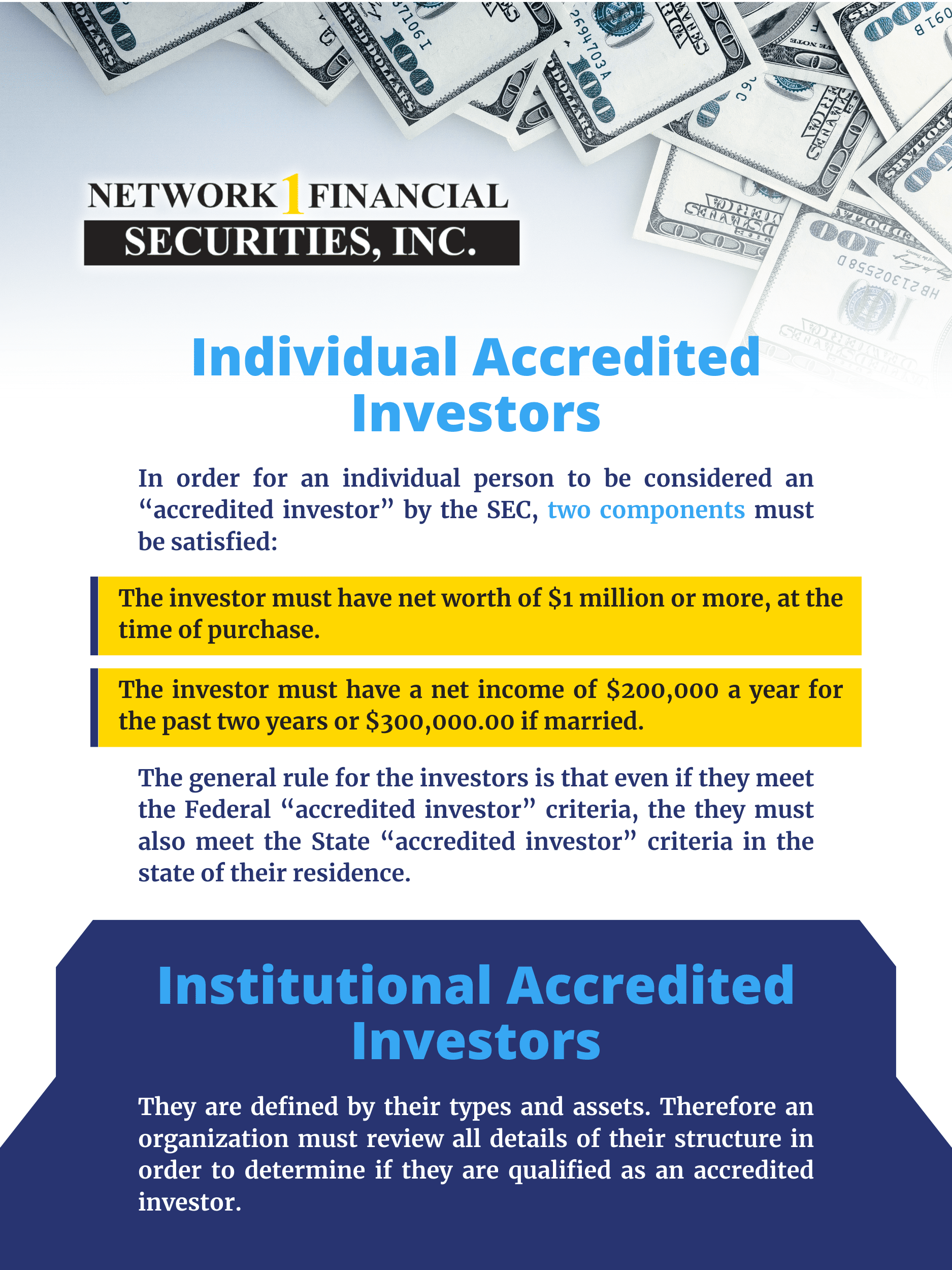

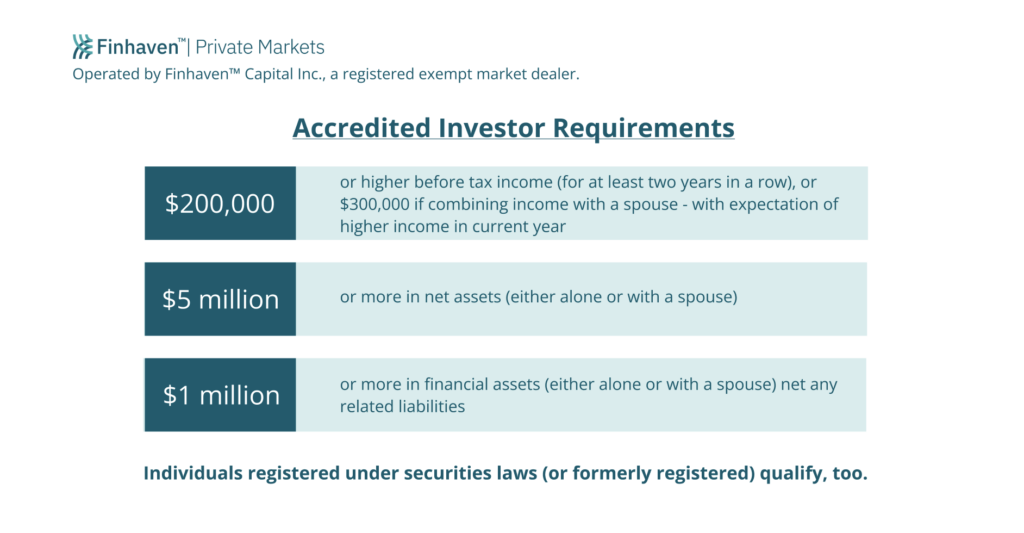

The newly adopted amendments for the very first time accredit individual capitalists based on financial refinement demands. The changes to the recognized investor definition in Policy 501(a): consist of as certified investors any kind of trust, with complete possessions a lot more than $5 million, not formed especially to acquire the subject securities, whose purchase is guided by a sophisticated person, or consist of as certified capitalists any type of entity in which all the equity owners are certified investors.

There are a number of enrollment exceptions that ultimately expand the world of potential financiers. Numerous exceptions require that the financial investment offering be made just to individuals that are certified capitalists (qualification of investors).

In addition, certified investors commonly get extra desirable terms and greater prospective returns than what is available to the public. This is due to the fact that personal placements and hedge funds are not called for to conform with the exact same regulatory demands as public offerings, permitting even more flexibility in terms of investment approaches and prospective returns.

How To Become An Accredited Investor In Canada

One factor these security offerings are restricted to certified investors is to make sure that all taking part financiers are monetarily innovative and able to fend for themselves or sustain the danger of loss, therefore making unnecessary the protections that come from an authorized offering.

The internet worth examination is reasonably straightforward. Either you have a million dollars, or you do not. On the earnings test, the individual must satisfy the thresholds for the three years consistently either alone or with a spouse, and can not, for example, satisfy one year based on specific revenue and the following 2 years based on joint revenue with a partner.

Latest Posts

Unpaid Taxes On Homes For Sale

Sale Tax Property

Houses Up For Tax Sale Near Me